Consolidated Financial Performance FY16

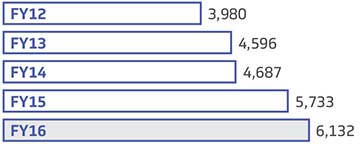

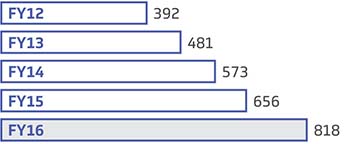

Sales & Services (₹ in Crores)

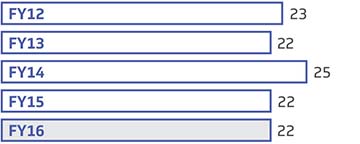

Share of International FMCG Business (%)

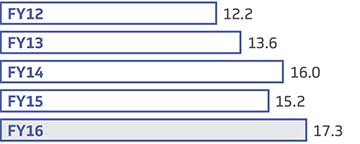

EBITDA Margin (%)

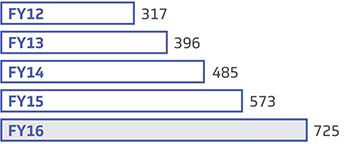

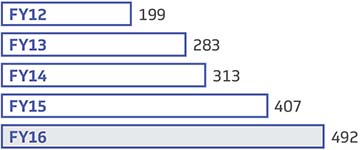

Net Profit (₹ in Crores)

Dividend Declared (%)

Cash Profit (₹ in Crores)

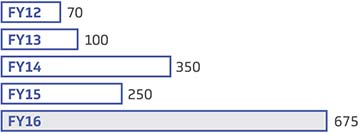

EVA (₹ in Crores)

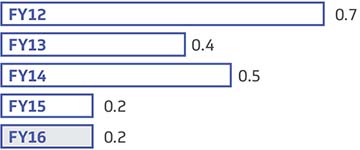

Debt/Equity

Sustainable wealth creation

A rupee invested in Marico at its IPO in May 1996 is worth ₹117 presently (on March 31, 2016) implying a compounded annual return of 27%. That same rupee would be worth just ₹7 if invested in the Sensex implying a CAGR of 10%. Thus, Marico has outperformed the Sensex by over 17.8x over the past 20 years.

Investment |

Through |

Shares |

Value ( in ₹ ) |

Indexed Value |

April 1996 - Original |

IPO |

100 |

17,500 |

100 |

August 2002 |

Bonus (Equity 1:1) |

200 |

- |

- |

September 2002 |

Bonus (Preference 1:1) |

200 |

- |

- |

May 2004 |

Bonus (Equity 1:1) |

400 |

- |

- |

February 2007 |

Share Split (10:1) |

4000 |

- |

- |

December 2015 |

Bonus (Equity 1:1) |

8000 |

- |

- |

Holdings and Cost as on March 31, 2016 |

8,000 |

17,500 |

100 |

|

|

|

|

|

|

Return |

Through |

Shares |

Value ( in ₹ ) |

Indexed Value |

March 31, 2016 |

Market value |

8000 |

19,60,000 |

11,200 |

March 2004 |

Redemption proceeds of Bonus |

200 |

2,000 |

11 |

April 1996 - March 2016 |

Dividend Received*# |

|

83,899 |

479 |

Gross Returns |

20,45,899 |

11,691 |

||

|

|

|

|

|

Compound Annual Return since IPO |

27% |

27% |

||

# Subject to taxes as applicable