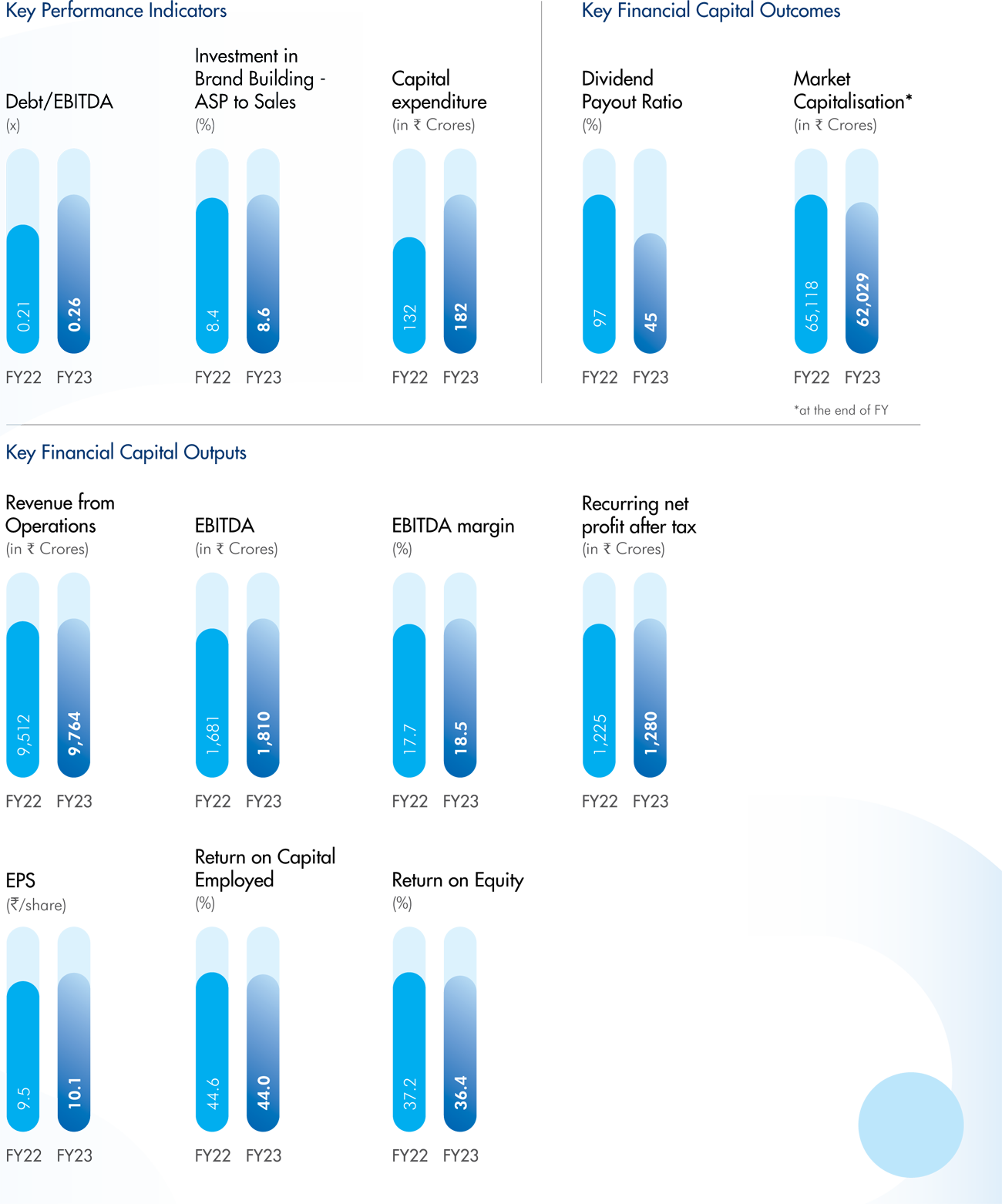

During the year, the Company incurred capital expenditure of H 182 Crores for capacity expansion and maintenance of existing manufacturing facilities. Cash generated from operations, at H 1,419 Crores in FY23, remained the primary source of liquidity. The institutionalized cost management program, MarVal, continued to support the Company’s strategic objectives amidst challenging demand conditions and input cost volatility during the year.

The Company has a comprehensive risk management framework, which aids in execution of its long-ter m strategy as it integrates the possible risks and mitigation initiatives in business planning processes. The Company drove profitable operations and enjoyed a comfortable net cash surplus situation during the year. Net surplus at the end of the year was at H 1,301 Crores. While current borrowings are mainly for working capital requirements, the Company actively explores opportunities to optimise borrowing costs and maximise yield on investments, while maintaining conservative guardrails on safety, liquidity and returns. The Company ensures adequate access to funding and leverages the surplus to meet its operating needs and strategic objectives while following a prudent cash flow management approach. Moreover, in case any exigencies arise in future af fecting the liquidity position, the Company would be in a comfor table position to borrow capital given that it enjoys AAA credit rating and maintains a strong balance sheet. As on March 31, 2023, its Debt/EBITDA was at a comfortable level of 0.26x.

The company continued to report healthy capital efficiency ratios during the year. In FY23, Return on Capital Employed (ROCE) was at 44.0% and Return on Equity (ROE) was at 36.4%.

Financial Performance

In FY23, Marico achieved a consolidated turnover of H 9,764 Crores, up 3% YoY, and recurring consolidated PAT of H 1,280 Crores, up 4% YoY. The operating margin stood at 18.5%, up 87 bps.

A detailed discussion on the financial and operational performance in FY23 is available in the Management Discussion and Analysis section of the Report.